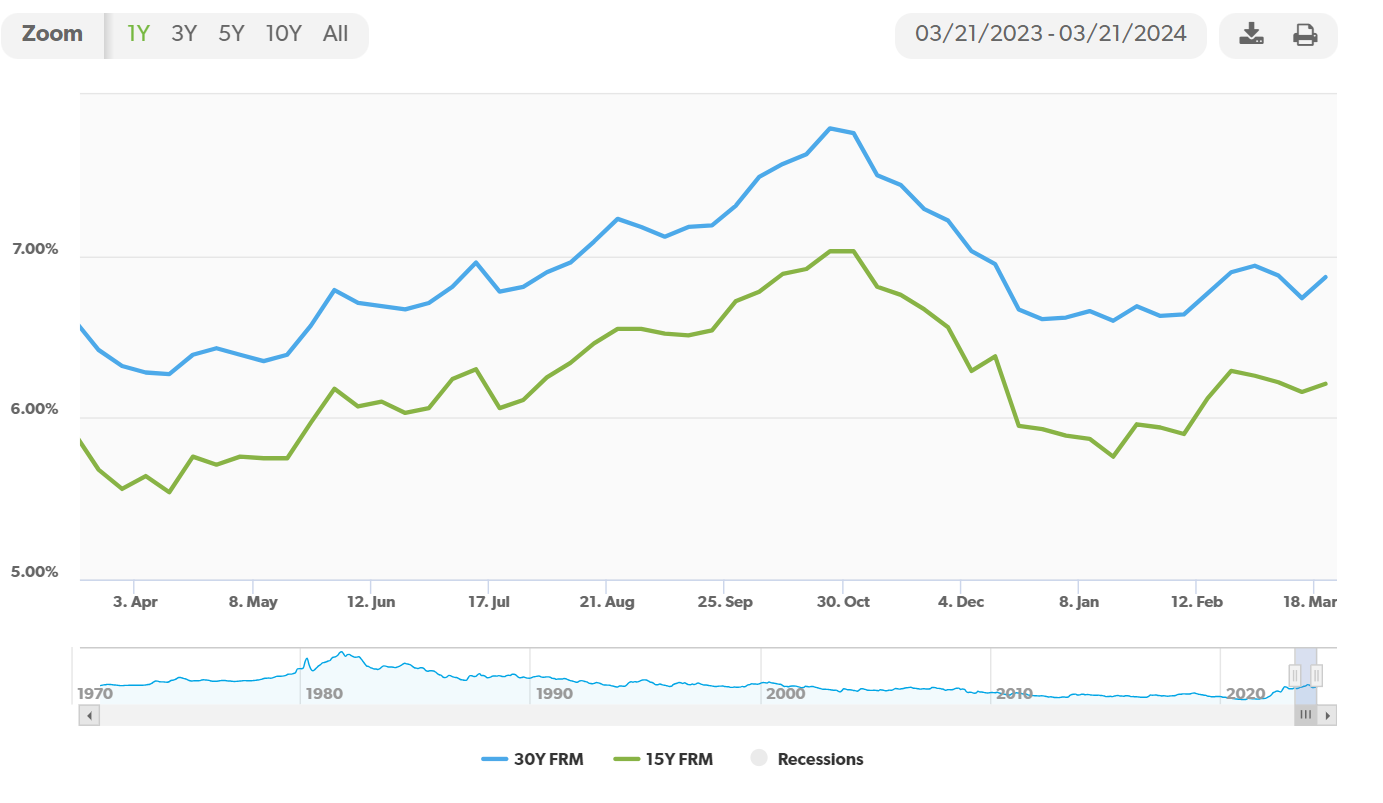

Modest Uptick in Mortgage Rates

Nearing the Seven Percent Mark

[Credit, Freddie Mac, March 21, 2024]

Mortgage rates are starting to rise again after a brief period of decline. This change comes as the spring homebuying season begins, with a slight increase in the number of existing homes available and a pickup in new home construction. Despite these higher rates, homebuilders are feeling more positive about the housing market. They’re seeing pent-up demand, a shortage of homes for sale, and they expect the Federal Reserve to lower rates later in the year. According to Freddie Mac’s Primary Mortgage Market Survey® as of March 21, 2024, the average weekly rates in the U.S. show the 30-year Fixed-Rate Mortgage (FRM) at 6.87%, and the 15-year FRM at 6.21%.

Overview of the U.S. Housing and Mortgage Market

In January 2024, Freddie Mac’s indicators showed total home sales (existing + new) were at 4.66 million, up 2.9% from December 2023 but down 1.2% from January 2023. Existing home sales saw a 3.1% increase from December 2023 to 4.0 million in January, the largest monthly gain in a year. However, they’re still 1.7% lower than January 2023 levels. The existing housing inventory in January 2024 grew slightly by 2% from December 2023, reaching 1.01 million units, representing a 3.0-month supply at the current sales pace. The median price rose to $379,100, up by 5.1% from last year, contributing to affordability challenges in the market..

New Home Sales

In January 2024, new home sales were at 661,000, 1.5% higher than December 2023. With affordability becoming more difficult, 62% of builders offered sales incentives in January, while 25% reduced prices according to the National Association of Home Builders (NAHB). Housing starts decreased by 14.8% from December 2023, mainly due to a 35.8% decline in multifamily unit construction. Despite a slowdown in December, house prices continued to rise, with the FHFA Purchase-Only Home Price Index for December 2023 increasing by 0.1% month-over-month and 6.6% year-over-year.

Outlook

Looking ahead, the U.S. economic outlook remains positive, with analysts expecting modest growth. However, they anticipate a slower pace compared to the previous year, leading to slower job growth and a slight increase in the unemployment rate. Inflation is expected to remain above 2% due to a growing economy, delaying potential rate cuts by the Federal Reserve until at least summer. Analysts forecast mortgage rates to stay above 6.5% for the near future. Despite challenges like high mortgage rates and limited inventory, analysts expect a modest recovery in home sales later in the year as rates decrease.

Final Thoughts

While analysts remain optimistic, there’s a need for caution as the battle against persistent inflation could extend. Any deterioration in credit quality could impact housing demand, although major negative credit events are not expected under the baseline scenario.

By Ready Rate, Updated March 23, 2024

Subscribe to our blog

Subscribe to our blog and be the first to discover the latest trends, insights, and market updates tailored for real estate professionals to ensure you stay ahead in this dynamic market. Ready Rate, the easiest way to reach your goals.

Got mortgage questions? You have an expert on your side at Ready Rate! Contact us now to speak with a LIVE person who cares about you, asks the right questions, and knows how to listen.

LAST BLOGS

SOCIAL MEDIA

Ready Rate | FL MBR4479 | MI FL0024879 | CO NMLS 2154342

335 E Thatch Palm Circle, Ste 101

Jupiter, FL 33458

For information purposes only. This is not a commitment to lend or extend credit. Information and/or dates are subject to change without notice. All loans are subject to credit approval. subject to credit approval.

Our website is ADA compliant, and we are committed to website accessibility

Design By © 2024 Naranja Brand. All rights reserved | Dev By Andrés Quintana Full Stack Developer