Is a USDA Home Loan Right for You?

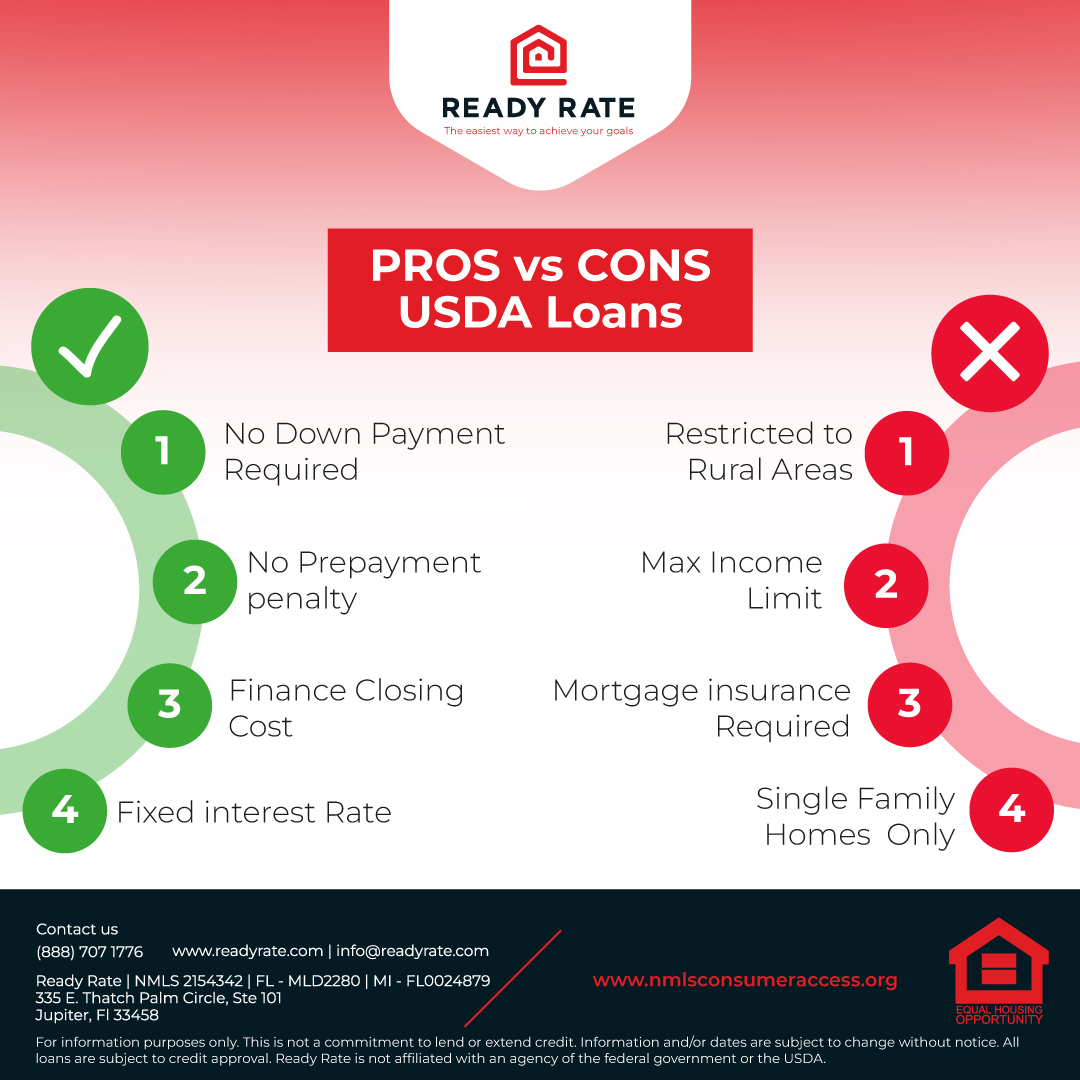

If you are seeking to purchase a home in a rural area, then your home could qualify for a USDA Home loan (also known as the USDA Rural Development Guaranteed Housing Loan Program). This mortgage loan can help eligible buyers with low to moderate incomes purchase homes in qualified areas.

USDA Loan Details

- Little to no downpayments

- 100 percent financing available

- Flexible credit guidelines

- Finance closing costs in the loan (if market value is sufficient)

- Not limited to first time homebuyers

- Borrowers must meet local income limits and must not own another property

- Gifts permitted for closing costs

- Property must be located in eligible area as defined by USDA

Subscribe to our blog

Subscribe to our blog and be the first to discover the latest trends, insights, and market updates tailored for real estate professionals to ensure you stay ahead in this dynamic market. Ready Rate, the easiest way to reach your goals.

Got mortgage questions? You have an expert on your side at Ready Rate! Contact us now to speak with a LIVE person who cares about you, asks the right questions, and knows how to listen.

LAST BLOGS

SOCIAL MEDIA

Ready Rate | FL MBR4479 | MI FL0024879 | CO NMLS 2154342

335 E Thatch Palm Circle, Ste 101

Jupiter, FL 33458

For information purposes only. This is not a commitment to lend or extend credit. Information and/or dates are subject to change without notice. All loans are subject to credit approval. subject to credit approval.

Our website is ADA compliant, and we are committed to website accessibility

Design By © 2024 Naranja Brand. All rights reserved | Dev By Andrés Quintana Full Stack Developer